April 15th is just days away… However, April 15th this year is not as important as it usually is.

Because of current hardships placed on individuals and businesses, the Internal Revenue Service has changed the tax filing and payment date for 2019 income tax returns to July 15, 2020. We notified our clients of this a couple weeks ago, but it is such an unusual year that it is worth repeating. Yes, your Tax Day party will probably be a pool party this year.

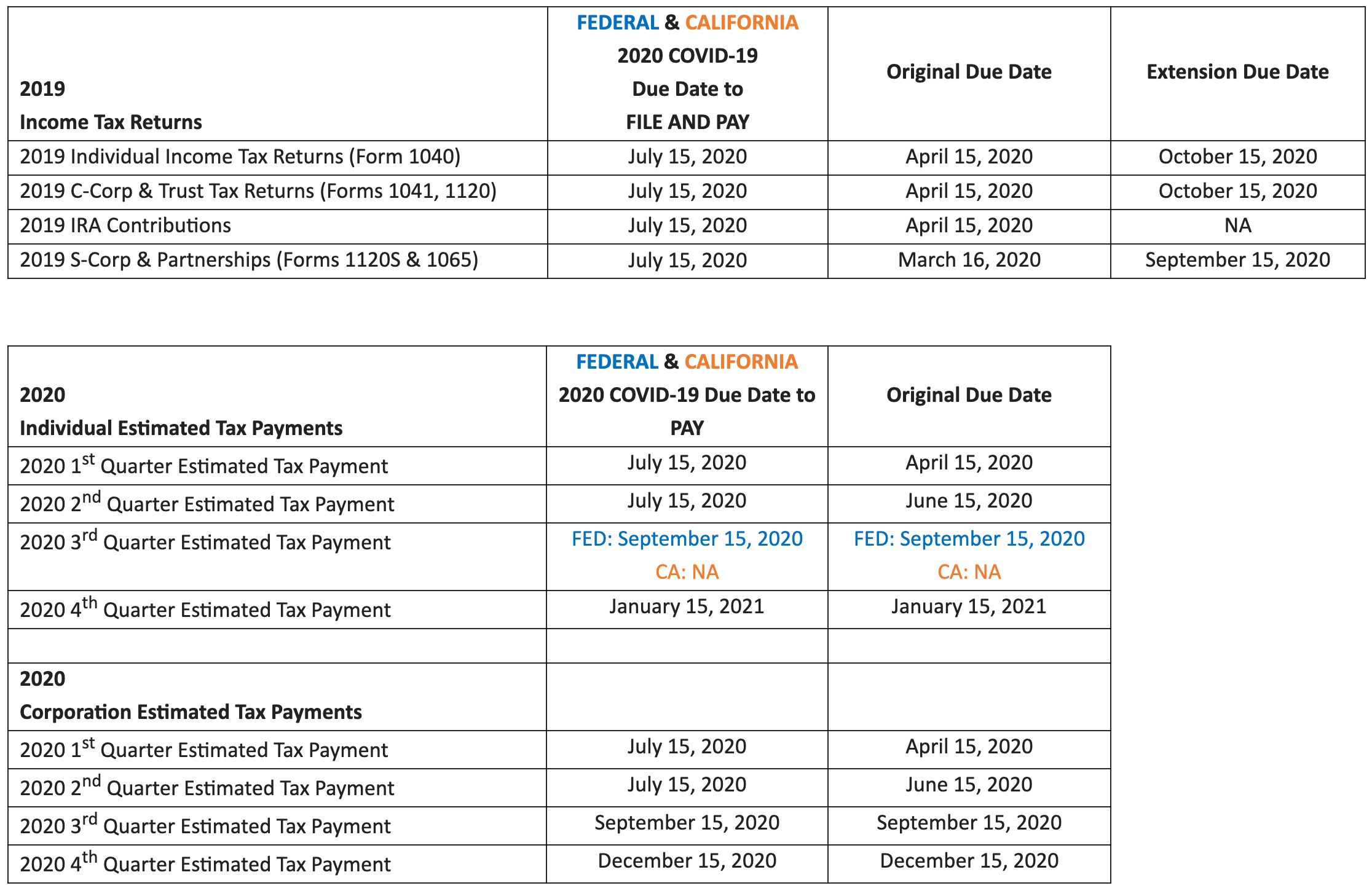

Many of you have inquired about filing an extension or making estimated tax payments within the next week. We would like to clarify that all filings and payments that are typically due on April 15th are due on July 15th. No actions are needed on April 15, 2020 as it relates to your income taxes, not even an extension.

This also relates to all IRA payments that usually need to be made by April 15th. You have until July 15, 2020 to fund your 2019 IRAs.

We appreciate your patience with us as we try to manage the COVID-19 crisis and advise our clients on the best path forward. We still plan to prepare your tax returns as quickly as possible, but helping our clients navigate cash flow, SBA loan options, the CARES Act, staff layoffs, and other COVID related issues has taken over as our number one priority. Additionally, because many of our staff are working from home with limited resources, we are operating at a reduced capacity.

If you need an expedited tax return, please let us know and we will do our best to accommodate. Again, please be patient with us considering the current environment.

Below is a summary of all the filing and payment dates for the upcoming months. Please note that the 2020 2nd quarter Federal estimated tax payment was just moved to July 15th as well.

Please reach out with any questions.